Protect the life you love with LifeSearch

Find your perfect life cover with us

0

lives protected

Get quotes from the UK's leading insurers

Want to talk to an expert?

Talk through your needs and life stage with a LifeSearch adviser. If you like, your adviser can find bespoke life cover quotes for you fee-free. Then you decide what to do next.

UK-based experts can help explain how it all works

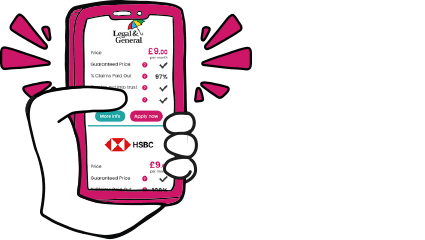

Search, compare & buy now

Just pop your details into our simple self-service option to get quotes from leading UK insurers. Choose a guaranteed price quote and you can buy it right now without needing to add more on an insurer site.

Quick cost & cover calculator

Work out what insurance you might need and see estimated costs with just a few simple questions, and see how the price changes dynamically. You can then buy online or speak to an adviser.

Perfect if you're nearly ready to buy to get a feel of how much life cover costs

Easy guides to help you get started

A quick guide to life insurance

Life insurance can be confusing. Our three-minute guide tells you everything you need to know.

By Katie Crook-Davies, Protection Writer

2 min read

A quick guide to income protection insurance

Income protection insurance is a product we think you should know more about. Get the facts in our two-minute guide.

By Katie Crook-Davies, Protection Writer

2 min read

A quick guide to critical illness insurance

Did you know that critical illness insurance can protect you against over 50 different illnesses?

By Katie Crook-Davies, Protection Writer

5 min readAlready have cover through LifeSearch?

Whether you need to update your policy, access support services or make a claim, we’ve got you covered.

£208 billion

Total amount insured since 1998.

Here to help you in advice, claims and everything in between

LifeSearch are recommended by